Helpful Information

Local Property Tax Guide

Local Property Tax (LPT)

An annual self-assessed Local Property Tax (LPT) charged on the market value of all residential properties in the State will come into effect from 1 July 2013. It will be administered by Revenue and a half-year charge will apply in 2013.

On 7 March 2013 Revenue Chairman Josephine Feehily outlined how Revenue will administer the Local Property Tax.

Revenue will write to residential property owners over a four week period commencing on 11 March enclosing an LPT Return and a detailed guide to Local Property Tax. Due to the volume of correspondence involved, the distribution process will take approximately four weeks.

The guide will provide information on how to assess the value of your property and calculate your LPT liability. It will also explain your payment options and how to complete your Return. The most straightforward way to submit your Return will be on-line at www.revenue.ie

1. What is Local Property Tax (LPT) ?

Local Property Tax (LPT) is a tax payable on the market value of residential properties in the State. A half-year charge applies for 2013. From 2014, LPT will apply on a full-year basis.

2. What does "Residential Property" mean for LPT purposes ?

A "Residential Property" is any building (or part of a building) which is used as, or is suitable for use as, a residence and includes any yard, gardens, driveway or other land associated with the property up to one acre in size. It also includes any other buildings or structures that belong with the residence such as garages and sheds.

3. Who is liable to pay LPT (the "Liable Person") ?

The following persons are liable to pay LPT:

- Owners of Irish residential property, regardless of whether they live in Ireland or not.

- Landlords where the property is rented under a short-term lease (for less than 20 years).

- Local authorities or social housing organisations that own and provide social housing.

- Lessees who hold long-term leases of residential property (for 20 years or more).

- Holders of a life-interest in a residential property.

- Persons with a long-term right of residence (for life or for 20 years or more) that entitles them to exclude any other person from the property.

- Personal representatives of a deceased owner (e.g. executor/administrator of an estate).

- Trustees, where a property is held in a trust.

- Where none of the above categories of liable person applies, the person who occupies, or receives rent from, the property is the liable person.

The Form LPT1 (the "Return") refers to the above persons as the "liable person". As LPT is a self-assessed tax, the liable person must complete and submit the Return, calculate the liability and pay any tax due.

4. What if I jointly own the property ?

If you are not the sole owner of the property, you should agree with the other owner(s) who is to complete and submit the Return and pay the tax due. If no one pays, Revenue can collect the tax due from any of the owners. Please note that only one Return is required per property. If more than one Return has issued in respect of the same property please inform Revenue by writing to: LPT Branch, P.O. Box 1, Limerick.

5. When must I own the property to be liable to pay LPT ?

If a property is a residential property on the ownership date in a year, LPT is due to be paid on the property. If you are the liable person in respect of the property on the ownership date you are liable to pay the LPT.

For 2013 the ownership date is 1 May 2013 and for any other year it is 1 November in the preceding year. Therefore, if you own a residential property on 1 May 2013, you are liable to LPT for 2013. If you sell your property after 1 May 2013 you are still liable to LPT for 2013 and the liability is payable in full at the time of the sale.

If you have purchased a new and unused property since 1 January 2013 or if you are a first-time buyer who purchased a property since 1 January 2013 as your sole or main residence an exemption from LPT applies. Although exempt, you are still required to complete and submit a Return.

6. I have received a Return but I am not the liable person, what do I have to do ?

Because Revenue has compiled a Register of residential properties from various sources, it may contain errors in relation to the ownership of some properties. If you receive a Return and you consider that you are not the liable person for the property, or that the property is not a residential property (see Question 2),

you should inform Revenue by writing to: LPT Branch, P.O. Box 1, Limerick within 30 days of the date of the enclosed letter and include:

● The name(s), address(es) and PPSN(s) of the liable person(s).

● The reason(s) why you consider you are not the liable person or why the property is not a residential property.

● Whatever supporting documentation (copies are sufficient) may be relevant, e.g. copy of a lease agreement if you are a tenant; proof of sale of the property before 1 May 2013 etc.

Based on this information Revenue will consider your claim and make a decision on the matter. It is important that you contact Revenue to correct our Register because in the absence of any correction, you are liable to pay the tax.

7. As a liable person, what do I have to do ?

If you are the liable person in respect of the property you are responsible for completing and submitting the Return and paying the tax due. To complete your Return, follow these 4 steps:

1. Decide the current market value of your property.

2. Identify the valuation band and calculate the LPT due.

3. Select your preferred payment option or check to see if you qualify for a deferral or exemption.

4. Submit the completed Return.

If you do not receive a Return for any property for which you are the liable person you are still required to submit a Return. You can complete and submit a Return at www.revenue.ie or alternatively contact the LPT Branch and a paper Return will be sent to you for completion.

8. How do I complete and submit my Return ?

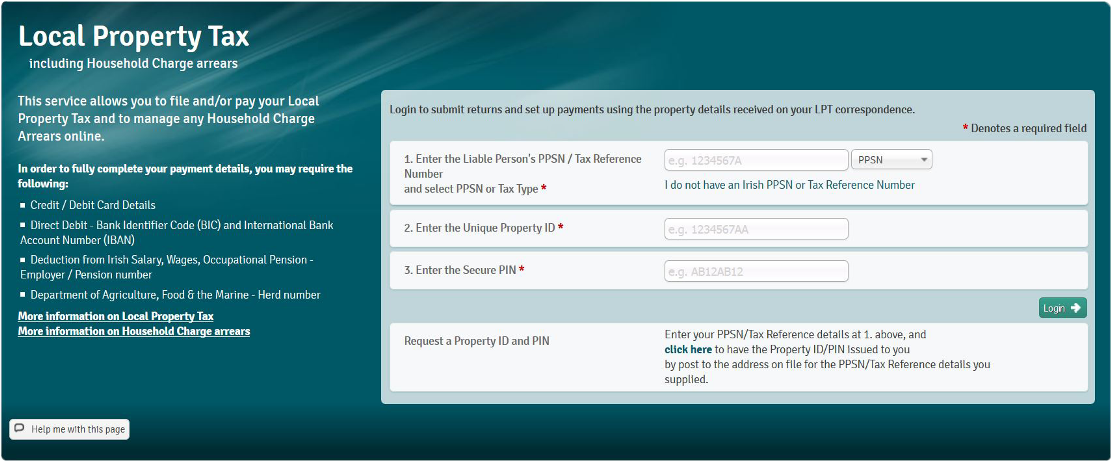

The quickest and most straightforward way to complete and submit your Return is on-line at www.revenue.ie using the Property ID and PIN provided on the Return. You will also need your PPSN or tax reference number. An extended deadline of 28 May 2013 applies if submitting your Return on-line. If you complete the paper Return you must submit this by no later than 7 May 2013.

If you own more than one residential property or if you are already obliged by law to make your tax returns on-line, you must submit the Return on-line.

9. How do I calculate how much I have to pay ?

The amount you pay depends on the market value of your residential property on 1 May 2013 as assessed by you. Property values are organised into a number of value bands up to €1m. The tax liability is calculated by applying 0.18% to the mid-point of the relevant band. Residential properties valued over €1m are assessed on the actual market value at 0.18% on the first €1m in value and at 0.25% on the portion of the value above €1m. The table on Page 14 contains a ready-reckoner of LPT calculations for 2013 and 2014.

10. How do I value my property ?

As LPT is a self-assessed tax, you are obliged to determine the market value of any property for which you are the liable person. The market value of your property on 1 May 2013 will form the basis of the calculation of the tax for 2013, 2014, 2015 and 2016 and will not be affected by any repairs or improvements made to your property, or any general increase in property prices, during this period.

Any increase in the value of a property arising from expenditure on adaptations to make it more suitable for a disabled person will not be taken into account where the adaptations have been grant-aided under a local authority scheme. See www.revenue.ie for details on how to apply this adjustment.

The following may assist you in valuing your property:

● Property valuation guidance is available on www.revenue.ie which includes an on-line guide that provides indicative property values. If you do not have internet access, terminals are available at Revenue Information Offices and local libraries. You can also contact the Citizens Information Service for assistance: Phone Service: 0761 07 4000, Monday to Friday, 9am - 8pm or in person by calling to a Citizens Information Service near you.

The valuation guidance is based on:

- The type of property e.g. detached, semi-detached, apartment etc.

- The age of the property e.g. built before the year 2000 or after.

- The average price of the type of property for the general area.

If your property has certain unique features, is smaller or larger than the average for your area, is in a significantly poor state of repair or has exceptional features, you will have to factor this into your assessment of the valuation of your property.

● The Residential Property Price Register at www.propertypriceregister.ie produced by the Property Services Regulatory Authority (PSRA), provides an actual sales price of all properties sold since January 2010.

● You may choose to obtain a valuation from a competent professional valuer. Some valuers are offering a special price for LPT valuations.

● If you have purchased your property or obtained a professional valuation in recent years, you may use this valuation and adjust for any change in values in your area since the date of this valuation.

You should also refer to other sources of information relating to local properties such as the property section of local newspapers, information from local estate agents and property websites.

Self-assessment requires you to honestly assess the value of your property. If you follow Revenue's guidance honestly, we will accept your assessment and your valuation will not be challenged. However, if you feel that the guidance is not indicating a reasonable valuation for your property, you should make your own assessment. Revenue will challenge cases where deliberate under-valuation occurred. You are responsible for ensuring that you choose the correct value band for your property.

11. How can I pay ?

You can opt to pay your LPT liability in one single payment or to phase your payments in equal instalments from 1 July 2013 until the end of the year. The payment method you select for 2013 will automatically apply for 2014 and subsequent years unless you advise Revenue that you wish to select an alternative method.

LPT can be paid in full by:

● Single Debit Authority - like an electronic cheque. To select this option complete the payslip on the Return and payment will be deducted from your bank account no earlier than 21 July 2013.

● *Debit/Credit Card.

● *Cash payments (including debit/credit card) through approved Payment Service Providers.

LPT can be paid on a phased basis from 1 July 2013 by:

● Deduction at source from your salary or occupational pension.

● Deduction at source from certain payments received from the Department of Social Protection (DSP) and scheme payments received from the Department of Agriculture, Food and the Marine (DAFM). Deduction from a DSP payment cannot reduce your DSP personal rate payment to less than €186 per week.

● *Direct Debit.

● *Cash payments (including debit/credit card) in equal instalments through approved Payment Service Providers.

*Charges may be levied by your Financial Institution or Payment Service Provider. Details of approved Payment Service Providers can be found at www.revenue.ie or by calling the LPT Branch.

If you choose a deduction at source option, Revenue will advise your employer, pension provider or the relevant Government Department of the amount to be deducted.

12. What if I can't afford to pay ?

A system of deferral arrangements is available where there is an inability to pay and certain specified conditions are met. If you qualify for full deferral (Conditions 1 & 2 below) you can opt to defer 100% of your liability. If you qualify for partial deferral (Conditions 3 & 4 below) you can opt to defer 50% of your liability and you must select a payment option to pay the balance of the liability.

Interest will be charged on LPT amounts deferred at a rate of 4% per annum. The deferred amount, including interest, will attach to your property and will have to be paid before the property is sold or transferred.

The deferral conditions (1 to 4) listed below are available to owner-occupiers only. They are not available

for landlords or second homes. The deferral conditions are as follows:

| Condition Number | Condition | |

| Full Deferral |

1 | Gross income* for the year is unlikely to exceed €15,000 (single or widow/er) and €25,000 (couple). |

| Full Deferral |

2 | Gross income* for the year is unlikely to exceed the adjusted income limit. This adjusted limit is calculated by increasing the thresholds of €15,000 (single or widow/er) and €25,000 (couple) by 80% of the expected gross mortgage interest payments for the year 2013. |

| Partial Deferral |

3 | Gross income* for the year is unlikely to exceed €25,000 (single or widow/er) and €35,000 (couple). |

| Partial Deferral |

4 | Gross income* for the year is unlikely to exceed the adjusted income limit. This adjusted limit is calculated by increasing the thresholds of €25,000 (single or widow/er) and €35,000 (couple) by 80% of the expected gross mortgage interest payments for the year 2013. |

*Gross income is your income before any deductions, allowances or reliefs that may be taken off for income tax purposes. It includes income that is exempt from income tax and income from the Department of Social Protection but excludes Child Benefit. You are required to estimate on 1 May 2013 your gross income for 2013.

Sample Income Thresholds for Deferral

| Deferral (Partial) Income Limit |

Expected Mortgage Interest Payments |

80% of Expected Mortgage Interest Payments |

Adjusted Deferral (Partial) Income Limit |

|

| Single, Widow/er | €15,000 (€25,000) | €3,000 | €2,400 | €17,400 (€27,400) |

| Couple | €25,000 (€35,000) | €3,000 | €2,400 | €27,400 (€37,400) |

In these examples, if gross income does not exceed €17,400 (single, widow/er) or €27,400 (couple) you may opt for full deferral under Condition 2. If gross income does not exceed €27,400 (single, widow/er) or €37,400 (couple) you may opt for partial deferral under Condition 4 and pay the balance.

13. Are there any other deferral options ?

Deferral may also be available in the following circumstances:

Condition 5: Personal Representatives of a deceased liable person where a property has not been transferred or sold within 3 years of a liable person's death may apply for a deferral until the earlier of (a) the date the property is sold or (b) 3 years after the date of death.

Condition 6: A person who has entered into an insolvency arrangement under the Personal Insolvency Act 2012 may apply for deferral of the LPT that is due during the period for which the insolvency arrangement is in effect.

Condition 7: A person who suffers both an unexpected and unavoidable significant financial loss or expense, as a result of which he or she is unable to pay the LPT without causing excessive financial hardship, may apply for full or partial deferral. Claims for this type of deferral will require full disclosure of the person's financial circumstances and any other information required by Revenue in accordance with the detailed guidelines published at www.revenue.ie. Following an examination of the information provided, Revenue will determine whether deferral should be granted.

To claim deferral under any of these conditions enter the relevant condition number on your Return. You must also submit all supporting documentation, as required by the relevant Revenue guidelines, to LPT Branch, P.O. Box 1, Limerick.

14. Are any properties exempt from LPT ?

The following properties are exempt from LPT:

A. New and unused properties purchased from a builder or developer between 1 January 2013 and 31 October 2016 are exempt until the end of 2016.

B. Properties purchased by a first time buyer between 1 January 2013 and 31 December 2013 are exempt until the end of 2016 if used as the person's sole or main residence.

C. Properties constructed and owned by a builder or developer that remain unsold and that have not yet been used as a residence.

D. Properties in unfinished housing estates (commonly called "ghost estates"), specified by the Minister for the Environment, Community and Local Government. Further details are available at www.revenue.ie.

E. Properties that are certified as having a significant level of pyrite damage in accordance with regulations to be published by the Department of the Environment, Community and Local Government. Further details are available at www.revenue.ie.

F. Properties owned by a charity or a public body and used to provide "special needs" accommodation and support to people who have a particular need in addition to a general housing need to enable them to live in the community e.g. sheltered housing for the elderly and the disabled.

G. Registered Nursing Homes.

H. A property previously occupied by a person as his or her sole or main residence that has been vacated by the person for 12 months or more due to long term mental or physical infirmity. A property may also be exempt if the vacated period is less than 12 months and the person's doctor is satisfied that he or she is unlikely to return to the property. In both cases, the exemption only applies when the property is not occupied by any other person.

I. Properties purchased or adapted for use as a sole or main residence of a severely incapacitated individual who has received an award from the Personal Injuries Assessment Board or a Court or who is a beneficiary under a trust established for the purpose. Further details are available at www.revenue.ie.

J. Mobile homes, vehicles or vessels.

K. Properties fully subject to commercial rates.

L. Diplomatic properties.

M. Properties used by charitable bodies as residential accommodation in connection with recreational activities that are an integral part of the body's charitable purpose, e.g. guiding and scouting activities.

15. What happens if I don't submit a Return ?

A Notice of Estimate of LPT is included on the enclosed letter. This Estimate is not based on a valuation of your property nor should it be regarded as an accurate calculation of the amount of LPT you should pay.

If you don't submit a Return, or contact Revenue to say why you are not liable (see Question 6) Revenue will pursue you for this estimated amount of tax using a range of collection options including:

● Mandatory deduction from 1 July 2013 from your employment income, occupational pension or certain Government payments.

● Attachment of your bank account.

● Referral of the debt to a Sheriff or a Solicitor for collection.

● The withholding of any refund of other tax as payment against LPT due.

Because you have a Revenue debt, you will also not qualify for a Tax Clearance Certificate. Self-employed persons or companies will also be liable to a late filing surcharge on Income Tax or Corporation Tax Returns.

Interest charges at 8% per annum apply to late payment of LPT and penalties may also arise. Any unpaid LPT attaches to the property and you will not be able to sell it without paying any LPT, interest and penalties due.

16. Can I just pay the amount on the Notice of Estimate ?

If you consider that the amount shown on the Notice of Estimate accurately reflects your self-assessment, you should complete the Return on that basis, select a payment option and submit the Return.

17. Can I appeal ?

In general, because LPT is a self-assessed tax, formal appeals only arise in a small number of situations. If you are a liable person, you cannot appeal without making a Return and paying your self-assessed amount. If you don't agree with the Notice of Estimate, it is a simple matter to displace it by making your own self-assessment and submitting your Return. If you consider that you are not the liable person for the property that Revenue has connected you to, tell Revenue who is - see Question 6. If there is a disagreement between you and Revenue on matters relating to LPT, such as whether the property is residential, whether you are liable, matters to do with value, deferral etc. that cannot be resolved, Revenue will issue a formal Notice of Assessment or a formal decision or determination. You may appeal to the Appeal Commissioners against those notices and this will be set out clearly on the notices.

18. I didn't pay the Household Charge, what should I do ?

You should register with your local authority or with the Local Government Management Agency and pay the Household Charge. Any unpaid Household Charge at 1 July 2013 will be converted into an LPT charge of €200 and collected by Revenue in due course and may be subject to interest.

Property Valuation Bands & LPT Ready-Reckoner

| A | B | C | D | E |

| Valuation Band Number |

*Valuation Band Range (€) |

Mid-Point of Valuation Band (€) |

LPT Charge in 2013 (half year charge) (€) |

LPT Charge in 2014 (full year charge) (€) |

| 01 | 0 – 100,000 | 50,000 | 45 | 90 |

| 02 | 100,001 – 150,000 | 125,000 | 112 | 225 |

| 03 | 150,001 – 200,000 | 175,000 | 157 | 315 |

| 04 | 200,001 – 250,000 | 225,000 | 202 | 405 |

| 05 | 250,001 – 300,000 | 275,000 | 247 | 495 |

| 06 | 300,001 – 350,000 | 325,000 | 292 | 585 |

| 07 | 350,001 – 400,000 | 375,000 | 337 | 675 |

| 08 | 400,001 – 450,000 | 425,000 | 382 | 765 |

| 09 | 450,001 – 500,000 | 475,000 | 427 | 855 |

| 10 | 500,001 – 550,000 | 525,000 | 472 | 945 |

| 11 | 550,001 – 600,000 | 575,000 | 517 | 1,035 |

| 12 | 600,001 – 650,000 | 625,000 | 562 | 1,125 |

| 13 | 650,001 – 700,000 | 675,000 | 607 | 1,215 |

| 14 | 700,001 – 750,000 | 725,000 | 652 | 1,305 |

| 15 | 750,001 – 800,000 | 775,000 | 697 | 1,395 |

| 16 | 800,001 – 850,000 | 825,000 | 742 | 1,485 |

| 17 | 850,001 – 900,000 | 875,000 | 787 | 1,575 |

| 18 | 900,001 – 950,000 | 925,000 | 832 | 1,665 |

| 19 | 950,001 – 1,000,000 | 975,000 | 877 | 1,755 |

| 20 | Value greater than €1m | Assessed on the actual value as follows: ● at 0.18% on the value up to €1m ● at 0.25% on the portion above €1m |

||

*Valuation should be rounded to nearest whole Euro

SOURCE : Revenue April 2013

Comments