Helpful Information

How to save thousands by switching mortgage

How to save thousands by switching mortgage.

It will take a bit of time and effort, but switching your mortgage could save you a lot of money in the long-term.

Last year, just 15.5% of people made the switch, according to figures from the Banking and Payments Federation Ireland.

Financial advisers will tell you that is a big win for the banks, but not so much for the customers.

But the good news is the trend is increasing, with the BPFI figures showing that levels are up year on year from a low of 4.7% in 2012.

"There are lots of people thinking about it and talking about it, but I am baffled that I don't see more people actually doing it and doing it now," said Joey Sheahan, Head of Credit at MyMortgages.ie.

Switching could save you up to €3,000 a year depending on what rate you are on, according to Mr Sheahan, who said the process is not as difficult as you may think.

"People may have had an arduous journey with their initial mortgage and they may think that switching is going to be as difficult, but usually it is not. So I would say, get the paperwork, do your homework, get on with it and make your savings. It is better off in your pocket than in the bank's," he said.

But not everyone will benefit from switching, so we asked the experts who should consider it.

Who could benefit from switching?

Mortgage holders who are on standard variable rates are best placed to switch, according to Michael Dowling, Managing Director at Dowling Financial.

"These customers should check the current interest rate they are on and see if there are better options available," Mr Dowling advised.

At a recent Finance Committee hearing it was revealed that around 200,000 customers in Ireland are on standard variable rates.

But what rates are on offer at the moment?

"The standard variable rate currently ranges from as low as 3.15% with AIB, to as high as 4.5% with Permanent TSB and Bank of Ireland. So certainly there are significant savings to be made by customers who are on standard variable rates," Mr Dowling explained.

Switching will be an option for most people who took out a mortgage after 2008, as these customers are most likely paying a variable or fixed rate, said Mr Sheahan of MyMortgages.ie.

Who will not benefit from switching?

Not all mortgage holders should jump ship though.

"If existing mortgage holders are lucky enough to have an ECB related tracker rate, then you are probably paying a very good rate and switching wouldn't make sense," warned Mr Sheahan.

Is the threat of a move enough?

If you think you are a mortgage holder who could benefit from switching the first step is to approach your current lender, Michael Dowling said.

"Ring your own bank and check what interest rate you are on at the moment. Then advise that bank that you are thinking about switching mortgage. No bank will want to lose an existing customer. All of the banks have retention departments and their job is to ensure that you stay with them as an existing customer," he said.

Once you inquire about your current rate and inform your lender that you are thinking about moving, Mr Dowling said in most cases, the bank will offer you a better rate straight away.

He explained that customers will be offered an interest rate based on the loan relative to the value of the house.

"So for example, you could be on a standard variable rate of 4.5% with Bank of Ireland, but your loan relative to the value of your house might be 60% or 70%. They could immediately put you on an interest rate of 3% by very simply just making a telephone call," he explained.

When should you approach a broker?

While banks generally strive to retain customers, Mr Dowling said that is not always the case.

"Occasionally banks can be a bit stubborn and may not want to offer you a better rate. In that case you are clearly one of the customers that should consider moving to another lender," Mr Dowling said.

In this situation, he suggested you approach a broker to research the market on your behalf.

"Brokers don't charge fees typically; they are paid by the bank when the transaction is complete. So it is easy to get the broker to do the work for you and then they can come back to you to advise what options would be available to you," he said.

What are the benefits of switching provider?

Some banks simply don’t offer the most competitive rates to existing customers, so switching provider could be the answer.

Joey Sheahan, from MyMortgages.ie said customers could save up €3,000 a month by making the move.

"If you take somebody with a €350,000 mortgage and they are paying an interest rate of 4.5% over 30 years, they would be paying €1,773 per month, and they would pay total interest of €288,423.

"If that person switched to a standard variable rate of 3.15% with another lender, they could reduce their monthly payment to €1,504 a month, and they would pay total interest of €191,468, that's a difference of around €97,000 over the life of the mortgage," he continued.

Mr Sheahan also highlighted that most lenders will give a cash incentive, which would cover the costs associated with switching.

What costs are associated with switching provider?

According to Mr Dowling, the cost associated with switching provider is usually between €1,000 and €1,100 and will cover a valuation fee of around €150 and all legal fees.

He shared some detail on the current cash incentives offered by banks, to cover those costs.

"Typically banks are offering anything from €1,500 from Ulster Bank, AIB will pay €2,000, KBC will pay €3,000 and Bank of Ireland, Permanent TSB and the EBS will all pay 2% of the loan amount for you to move from your existing lender. So the costs of moving are going to be fully covered by any of the banks you intend moving to," he explained.

But Ross Connolly, Mortgage Advisor with Orca Financial, said it is important to note that cash-back offer, unless specifically for legal fees, cannot be used for legal fees on the switching application.

"You would need to show the new lender that the funds are already in place to pay this fee and that is why we would advise meeting with a broker at least six months before you plan to switch," he said.

What could go against you when you are looking to make the switch?

There are two obvious things that could go against you when you are looking at switching mortgage, according to Mr Dowling.

Being in negative equity will rule you out completely, he explained.

"So if the value of your mortgage is greater than the value of your house, unfortunately you have no option but to stay with your existing lender. You have no room to negotiate the interest rate because the loan is greater than the value. There are probably about 70,000 customers who are in negative equity, so unfortunately they have no option," he said.

A lender will also be wary of customers who have a bad credit rating, he added.

"For customers who had difficulties in the past in meeting their mortgage repayments or had difficulties in meeting repayments on term loans, there isn't a market for them to move. Banks are only interested in customers who have a clean credit rating," Mr Dowling added.

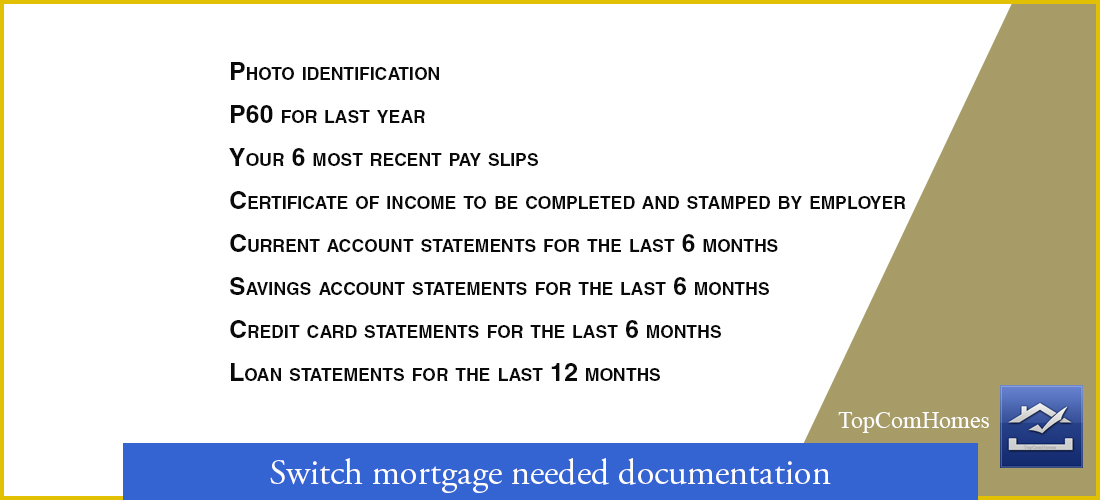

What documentation will you need?

If you do decide to switch, your application will be treated as a new mortgage.

Mr Dowling explained that this will require you to submit the same level of documentation you had to produce for your first mortgage, with the addition of a mortgage statement.

"It is one of the weaknesses of the process. I think the process is too slow and there is too much paperwork required and there should be concessions given for the fact that you are an established mortgage payer, you have an established credit history, unlike a first time buyer but for the moment the banks are still insisting on the same inches of paperwork," he said.

Under new rules introduced at the start of this year, Irish banks are now required to give mortgage customers more information about their loan in order to help them save money by moving to a better rate or switching provider.

The requirements are part of changes to the Central Bank's Consumer Protection Code on mortgages.

Source : RTE.ie 17/11/2019

Comments